All Categories

Featured

Table of Contents

Below are some kinds of non-traditional living benefits motorcyclists: If the policyholder outlasts the term of their term life insurance policy, the return of costs rider makes certain that all or component of the premiums paid are returned to the policyholder. This can interest those that want the assurance of getting their money back if the policy is never made use of.

The insurer will either cover the premiums or waive them.: The guaranteed insurability motorcyclist allows the insurance holder to buy additional protection at specific intervals without proving insurability. Helpful for those that expect requiring a lot more protection in the future, especially useful for younger policyholders whose requirements may raise with life occasions like marital relationship or giving birth.

Where can I find Riders?

Supplying financial relief during the painful event of a kid's death, covering funeral expenditures, and permitting time off job.

Instead of focusing on assisted living facility or helped living centers, the Home Health care Biker offers benefits if the insured needs home healthcare services. Allows individuals to receive treatment in the comfort of their very own homes. In situation of a separation, the Separation Defense Cyclist enables for modifications in policy possession or recipient classifications without requiring the consent of the originally called plan owner or recipient.

If the policyholder becomes unwillingly out of work, this motorcyclist forgoes the premiums for a specified duration. Makes certain the plan doesn't lapse during periods of financial challenge because of unemployment. It is vital to understand the conditions of each biker. The cost, advantage quantity, period, and particular triggers vary commonly among insurance policy service providers.

Not everybody is immediately eligible for life insurance coverage living benefit policy bikers. The particular qualification requirements can depend on a number of aspects, consisting of the insurance coverage firm's underwriting standards, the kind and regard to the policy, and the certain biker asked for. Below are some typical elements that insurance providers might consider:: Just certain types of life insurance policy plans may use living advantages cyclists or have them consisted of as typical functions.

What should I look for in a Term Life plan?

: Numerous insurer have age constraints when including or working out living benefits motorcyclists. A crucial disease rider might be readily available just to insurance policy holders below a particular age, such as 65.: Initial eligibility can be affected by the insured's health standing. Some pre-existing problems may make it testing to get particular motorcyclists, or they can result in higher premiums.

:: An insurance holder could need to be detected with one of the protected essential illnesses.: The insured might have to verify they can not execute a set number of Activities of Daily Living (ADLs) - Life insurance.: A physician usually should detect the policyholder with an incurable health problem, having actually a specified time (e.g., one year) to live

How does Mortgage Protection work?

As an example, a return of premium motorcyclist on a term plan could only be readily available if the policyholder outlasts the entire term.: For specific riders, specifically those relevant to wellness, like the crucial ailment motorcyclist, added underwriting could be needed. This can involve medical tests or comprehensive wellness surveys.

While life insurance coverage with living advantages supplies an included layer of protection and versatility, it's critical to be knowledgeable about possible downsides to make a well-informed decision. Below are some potential downsides to consider:: Accessing living benefits normally suggests that the survivor benefit is lowered by the quantity you withdraw.

What should I know before getting Living Benefits?

: Including living benefits bikers to a policy may lead to greater costs than a basic policy without such riders.: There could be caps on the amount you can withdraw under living benefits. As an example, some plans may limit you to 50% or 75% of the death benefit.: Living benefits can present additional intricacy to the policy.

While offering a specific dollar amount without certain information is tough, here are the regular variables and factors to consider that affect the expense. Life insurance policy business price their items differently based on their underwriting standards and run the risk of analysis versions. Age, health and wellness, lifestyle, occupation, life expectations, and whether or not you smoke can all influence the cost of a life insurance policy premium, and this brings over right into the cost of a rider.

Whether living benefit riders deserve it relies on your scenarios, monetary objectives, and risk resistance. They can be a beneficial enhancement for some people, however the extra expense might not be validated for others. Here are a few considerations to help establish if it may be right for you:: If your household has a substantial history of diseases, a critical disease rider may make more feeling for you.

However, one of the advantages of being guaranteed is that you make arrangements to place your life insurance policy in to a trust. This provides you higher control over who will certainly benefit from your policy (the recipients). You select trustees to hold the money amount from your plan, they will have discretion about which one of the recipients to pass it on t, just how much each will obtain and when.

Level Term Life Insurance

Review a lot more about life insurance policy and tax obligation. It is essential to keep in mind that life insurance policy is not a cost savings or investment strategy and has no cash money worth unless a valid claim is made.

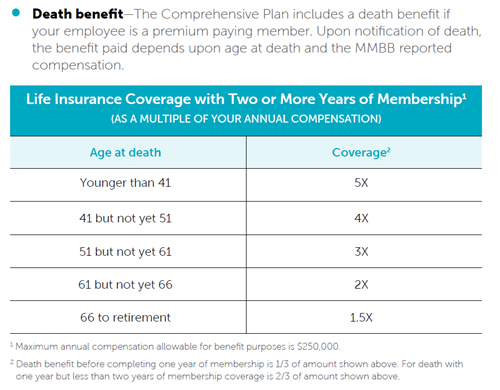

If you die while you are an energetic participant, your beneficiary or family member need to call your employer. The employer will assist in collaborating any benefits that may schedule. If you die while you are retired, your recipient or survivor need to call Securian Financial toll-free at 800-441-2258. VRS has acquired with Securian Financial as the insurance provider for the Team Life Insurance Policy Program.

If you were covered under the VRS Group Life Insurance Policy Program as a member, some benefits proceed right into retired life, or if you are eligible to retire however postpone retired life. Your insurance coverage will certainly end if you do not fulfill the age and service demands for retirement or you take a reimbursement of your participant payments and rate of interest.

The reduction price is 25% each January 1 till it reaches 25% of the overall life insurance policy advantage value at retired life. If you contend least three decades of solution debt, your insurance coverage can not reduce listed below $9,532. This minimum will certainly be increased every year based upon the VRS Strategy 2 cost-of-living modification computation.

Can I get Riders online?

On January 1, 2028, your life insurance policy coverage minimizes to $50,000. On January 1 adhering to three fiscal year after your employment ends (January via December), your life insurance policy protection decreases a last 25% and continues to be at that value for the rest of your retired life. Your last decrease will be on January 1, 2029, and your coverage will certainly continue to be at $25,000 * for the rest of your retired life.

Latest Posts

Benefits Of Burial Insurance

Funeral Expenses Insurance Policy

Difference Between Burial And Life Insurance