All Categories

Featured

Table of Contents

Term life insurance policy is a kind of plan that lasts a specific length of time, called the term. You choose the size of the policy term when you initially obtain your life insurance. It can be 5 years, 20 years and even more. If you pass away throughout the pre-selected term (and you've stayed on top of your costs), your insurance company will pay out a round figure to your nominated beneficiaries.

Choose your term and your amount of cover. You might have to address some inquiries about your clinical background. Select the plan that's right for you. Currently, all you need to do is pay your premiums. As it's level term, you understand your premiums will certainly stay the exact same throughout the term of the plan.

How does Level Term Life Insurance work?

(However, you do not receive any type of refund) 97% of term life insurance claims are paid by the insurance provider - ResourceLife insurance policy covers most scenarios of fatality, yet there will be some exemptions in the regards to the plan. Exemptions may consist of: Hereditary or pre-existing problems that you failed to divulge at the beginning of the policyAlcohol or medicine abuseDeath while committing a crimeAccidents while joining unsafe sportsSuicide (some plans omit fatality by suicide for the initial year of the plan) You can add crucial disease cover to your level term life insurance policy for an extra cost.Critical disease cover pays out a portion of your cover quantity if you are detected with a severe ailment such as cancer, cardiac arrest or stroke.

Hereafter, the policy finishes and the surviving companion is no much longer covered. Individuals typically secure joint plans if they have exceptional financial dedications like a home loan, or if they have kids. Joint plans are normally much more budget-friendly than single life insurance policy policies. Various other sorts of term life insurance coverage plan are:Lowering term life insurance policy - The quantity of cover minimizes over the length of the policy.

This safeguards the getting power of your cover quantity versus inflationLife cover is an excellent thing to have due to the fact that it offers monetary defense for your dependents if the worst happens and you pass away. Your liked ones can also use your life insurance policy payment to spend for your funeral service. Whatever they select to do, it's terrific tranquility of mind for you.

Nevertheless, level term cover is wonderful for meeting daily living costs such as house costs. You can likewise use your life insurance policy benefit to cover your interest-only home mortgage, settlement mortgage, school charges or any various other financial debts or continuous repayments. On the other hand, there are some drawbacks to degree cover, compared to various other sorts of life plan.

Who provides the best Level Term Life Insurance For Families?

Words "degree" in the expression "level term insurance coverage" suggests that this kind of insurance has a fixed premium and face quantity (survivor benefit) throughout the life of the plan. Put simply, when individuals speak about term life insurance policy, they generally describe level term life insurance policy. For the majority of individuals, it is the simplest and most affordable selection of all life insurance policy kinds.

Words "term" here describes an offered variety of years throughout which the degree term life insurance policy remains active. Level term life insurance policy is one of one of the most preferred life insurance coverage policies that life insurance policy suppliers use to their clients because of its simplicity and price. It is additionally very easy to compare level term life insurance policy quotes and get the very best premiums.

The device is as follows: To start with, select a policy, fatality benefit amount and plan period (or term length). Pick to pay on either a regular monthly or yearly basis. If your premature demise happens within the life of the policy, your life insurance company will certainly pay a swelling sum of survivor benefit to your established recipients.

What does Level Term Life Insurance cover?

Your level term life insurance coverage policy ends once you come to the end of your policy's term. Alternative B: Buy a new level term life insurance plan.

FOR FINANCIAL PROFESSIONALS We have actually designed to provide you with the very best online experience. Your current web browser could restrict that experience. You may be using an old web browser that's unsupported, or settings within your web browser that are not compatible with our site. Please save yourself some frustration, and upgrade your web browser in order to view our website.

Level Term Life Insurance For Families

Currently utilizing an upgraded internet browser and still having trouble? Your current internet browser: Finding ...

If the policy expires plan your prior to or you live beyond the policy termPlan there is no payout. You may be able to restore a term policy at expiration, however the premiums will be recalculated based on your age at the time of renewal.

Whole Life Insurance Policy Rates 30 $282 $247 40 $382 $352 50 $571 $498 60 $887 $782 Source: Quotacy. Quotes are for a $500,000 irreversible life insurance coverage plan, for guys and women in superb health.

Can I get Affordable Level Term Life Insurance online?

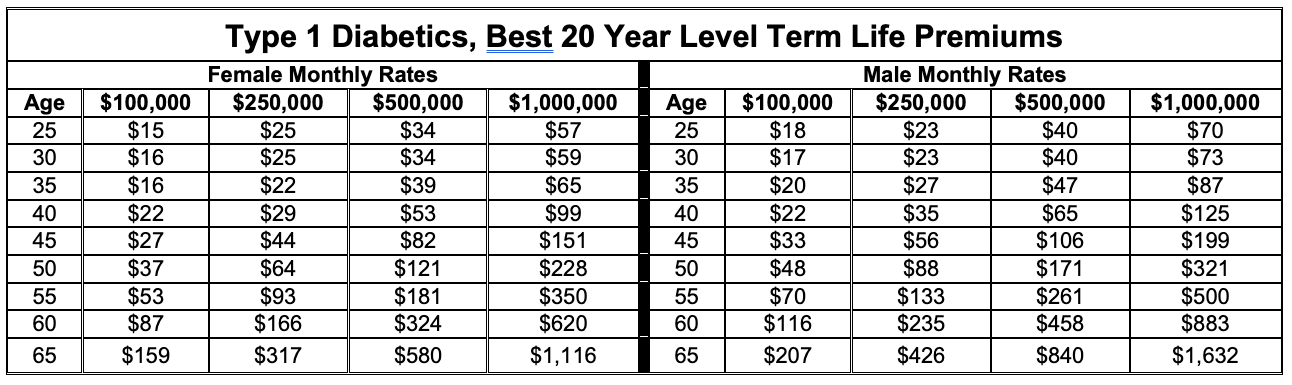

That lowers the overall threat to the insurance company compared to a long-term life plan. The minimized risk is one aspect that allows insurance companies to charge reduced premiums. Rate of interest, the financials of the insurance coverage business, and state laws can also impact costs. As a whole, business often offer much better prices at the "breakpoint" coverage degrees of $100,000, $250,000, $500,000, and $1,000,000.

He gets a 10-year, $500,000 term life insurance policy with a costs of $50 per month. If George passes away within the 10-year term, the policy will certainly pay George's beneficiary $500,000.

If he lives and renews the policy after one decade, the premiums will be higher than his first policy since they will certainly be based upon his present age of 40 instead of 30. Level death benefit term life insurance. If George is diagnosed with an incurable illness throughout the very first policy term, he possibly will not be eligible to restore the policy when it expires

There are several sorts of term life insurance policy. The very best choice will certainly depend on your specific scenarios. Normally, the majority of companies offer terms ranging from 10 to three decades, although a few offer 35- and 40-year terms. Level-premium insurance coverage has a set month-to-month payment for the life of the policy. A lot of term life insurance policy has a level premium, and it's the type we have actually been describing in the majority of this post.

How can No Medical Exam Level Term Life Insurance protect my family?

Thus, the premiums can come to be excessively pricey as the insurance policy holder ages. They may be a great alternative for someone that requires momentary insurance coverage. These plans have a survivor benefit that declines every year according to an established schedule. The policyholder pays a repaired, degree costs throughout of the plan.

Latest Posts

Benefits Of Burial Insurance

Funeral Expenses Insurance Policy

Difference Between Burial And Life Insurance